Incorporating Profit Margins in Your Pricing Strategy: #1 Key To Massive Success!

Incorporating Profit Margins in Your Pricing Strategy

Setting the right price for your products or services is crucial to your business’s success. The way you think about pricing can shape your profit margins. You need to understand how to include those margins in your pricing strategy. This article will guide you through the process of creating a pricing strategy that helps you make money while staying competitive.

Key Takeaways

- Know your costs: Understanding your expenses helps you set prices that cover costs and create profit.

- Calculate profit margins: Always include profit margins in your pricing. This ensures you make money on every sale.

- Consider market factors: Look at what competitors charge and how customers perceive prices.

- Adjust as needed: Be ready to change prices based on sales performance and market conditions.

For additional insights into optimizing your business finances, check out our guide on managing operational costs.

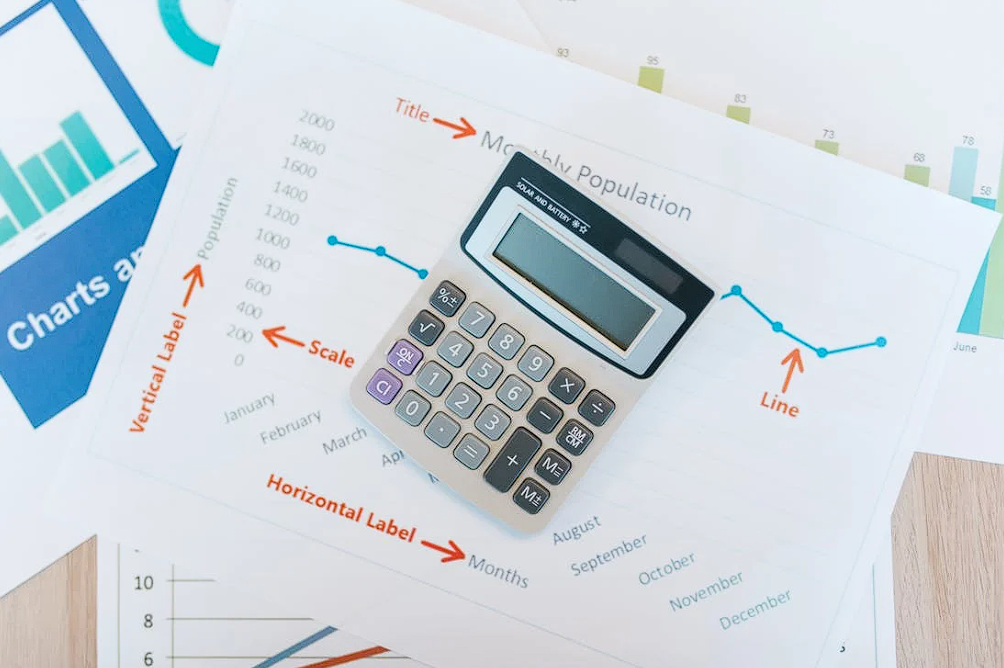

Understanding Profit Margins

Profit margins show how much money you keep after covering your costs. You can think of it as the difference between how much you sell a product for and how much it costs you to make it. There are two types of profit margins you should know:

Gross Profit Margin

This margin tells you how much you earn from sales after subtracting the cost of goods sold. To find this number, use the formula:

[\text{Gross Profit Margin} = \left( \frac{\text{Sales} – \text{Cost of Goods Sold}}{\text{Sales}} \right) \times 100]

Net Profit Margin

This margin shows how much profit you make after all expenses. It includes operating expenses, taxes, and interest. You calculate it like this:

[\text{Net Profit Margin} = \left( \frac{\text{Net Income}}{\text{Sales}} \right) \times 100]

Both margins are important. They help you understand your business’s health and how well you control costs.

Overview of Profit Margins

| Margin Type | Calculation Formula | Purpose |

|---|---|---|

| Gross Profit Margin | [\left( \frac{\text{Sales} – \text{COGS}}{\text{Sales}} \right) \times 100] | Measures profitability before operating expenses |

| Net Profit Margin | [\left( \frac{\text{Net Income}}{\text{Sales}} \right) \times 100] | Reflects overall profitability after all expenses |

Calculating Your Costs

Before you set prices, you need to know all your costs. This includes fixed costs and variable costs.

Fixed Costs

These costs stay the same, whether you sell one item or a hundred. Examples include rent, salaries, and insurance.

Variable Costs

These costs change based on how much you sell. They include materials, labor, and shipping.

By knowing both types of costs, you can calculate your total costs.

Setting a Price

Now that you know your costs, you can start setting a price. Your price should cover your costs and give you a profit. Here’s a simple way to do it:

- Add all your costs.

- Decide on your profit margin. This is how much profit you want to make per sale.

- Use this formula to find your price:

[\text{Price} = \text{Total Costs} + \text{Desired Profit}]

For example, if your total costs are 20 dollars and you want a profit of 5 dollars, your price should be 25 dollars.

The Role of Market Research

Understanding your market is key. You need to know what your customers are willing to pay. Research your competitors. Look at their prices and what they offer. This will help you position your price in the market.

Competitive Pricing

Check what similar businesses charge. If you set your price too high, customers may choose competitors. If it’s too low, you might lose money. Find a balance that works for your business.

Customer Perception

How customers view your price matters. They may think a higher price means better quality. On the other hand, a lower price could attract budget-conscious shoppers. You need to know your target audience.

Key Factors in Market Research

- Customer demographics: Understanding who your customers are can help tailor your pricing strategy.

- Price elasticity: Knowing how sensitive your customers are to price changes can guide adjustments.

- Competitor offerings: Analyzing competitor products and services helps identify gaps in your pricing strategy.

Adjusting Your Pricing

Prices are not set in stone. You may need to adjust them for various reasons.

Sales Data

Look at your sales data regularly. If something sells well, you might raise the price. If a product doesn’t sell, consider lowering the price or offering discounts.

Seasonal Changes

Some businesses experience seasonal sales. Adjust your prices based on demand. For example, a winter coat may sell better in fall than in spring.

Economic Factors

Watch economic changes too. If costs go up, you may need to adjust your prices to maintain profit margins.

The Importance of Profit Margins

Incorporating profit margins into your pricing strategy is essential. If you don’t account for profit, your business can struggle. Here’s why profit margins matter:

Business Growth

Higher profit margins mean more money to invest back into your business. You can upgrade equipment, hire staff, or expand your offerings.

Financial Stability

Good profit margins provide a cushion during tough times. If sales dip, having a healthy margin can keep your business afloat.

Competitive Advantage

If you can maintain a solid profit margin, you can stay competitive. You have more flexibility in pricing and can respond to market changes.

Creating a Sustainable Pricing Strategy

Your pricing strategy should be sustainable for the long term. Here are some tips:

Test Prices

Don’t be afraid to try different prices. A/B test can help you understand what works best.

Get Customer Feedback

Ask customers what they think about your prices. Their opinions can guide you in making adjustments.

Monitor Costs

Keep an eye on your costs. If they go up, you may need to adjust your prices to maintain your margins.

Pricing Strategy Effectiveness

| Pricing Strategy | Description | Advantages |

|---|---|---|

| Cost-Plus Pricing | Add a fixed percentage to costs | Simple to implement |

| Value-Based Pricing | Prices based on perceived value | Can yield higher margins |

| Dynamic Pricing | Adjust prices based on demand | Maximizes revenue opportunities |

| Penetration Pricing | Low initial price to gain market share | Attracts customers quickly |

Common Pricing Strategies

To incorporate profit margins effectively, explore different pricing strategies. Here are a few you might consider:

Cost-Plus Pricing

This strategy adds a set percentage to your total costs. For example, if your costs are 20 dollars and you want a 30% margin, your price will be 26 dollars.

Value-Based Pricing

Set prices based on what customers think your product is worth. This often requires a deep understanding of customer needs.

Dynamic Pricing

Adjust prices based on market demand. Airlines and hotels often use this strategy. Prices can change based on how many people are booking.

Penetration Pricing

This strategy involves setting a low price to attract customers quickly. Once you gain market share, you can increase the price.

Balancing Quality and Price

While setting your prices, remember the quality of your products or services. Customers may pay more for higher quality.

Quality Perception

If you sell high-quality products, customers may expect to pay more. Make sure your prices reflect the quality you offer.

Brand Positioning

Think about your brand’s position in the market. Are you a luxury brand or a budget-friendly option? Your pricing should match your brand identity.

Leveraging Technology in Pricing

Using technology can help you streamline your pricing strategy. Software tools can track costs, analyze sales data, and even suggest pricing adjustments based on market trends.

Business Software

Tools like MyOverhead can help you calculate your overhead costs, break-even points, and profit margins quickly. This can save you time and reduce guesswork.

Data Analysis Tools

Use software that analyzes customer behavior and sales patterns. This data can guide your pricing decisions.

For more on how to efficiently manage your pricing strategies, consider exploring our resources on effective financial management tools.

Conclusion

Incorporating profit margins into your pricing strategy is essential for business success. By knowing your costs, understanding the market, and being willing to adjust prices, you can create a strong pricing strategy that supports your profitability. Remember to check your numbers regularly and use tools like MyOverhead to make informed decisions. Pricing is not just about numbers; it’s about creating value for your customers while ensuring your business thrives.

Next Steps

- Start calculating your costs today.

- Explore different pricing strategies.

- Use technology to keep your pricing strategy effective.

By following these tips, you can build a pricing strategy that leads to success.Get your FREE DEMO today!

Leave a Reply