The Easy Way to Start Calculating Your Business Overhead Costs

MyOverhead is the industry-leading software solution specifically designed to help businesses gain total control over their overhead costs.

An Online Business Overhead

Cost Calculating Software Program

Easily Calculate (all) your Business Hourly Rates...

OVERHEAD RATE

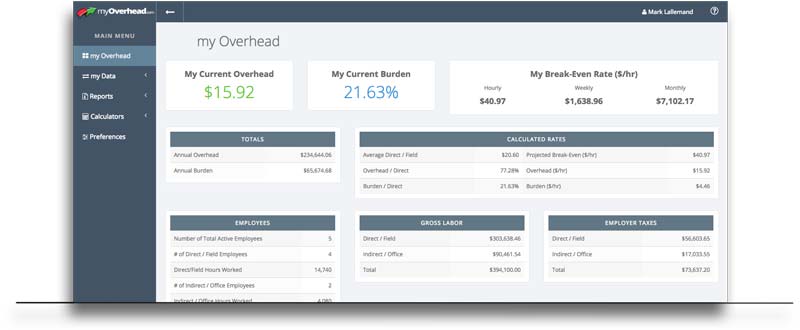

All Overhead Costs Including Rate Per Hour, Percentage of Labor and Annual

All Break-Even Costs Including Rate Per Hour | Week | Month | Annual and Sales Revenue

LABOR BURDEN RATE

All Labor Burden Costs Including Rate Per Hour, Percentage of Labor and Annual

LABOR GROUP RATE

All Business Numbers can be broken out by Divisions | Crews | Departments or any way you Require.

PROFIT MARGIN RATE

All Profit margin totals, annual, percentages and the most important, your profit per hour rate

SELLING RATE

How much you need to charge per hour to recover all operational costs with your profit margin included

Get started today in three simple steps

1

Start with Entering Info

2

Allocate your Costs

3

Adjust to Ensure Profits

The MyOverhead calculating system works for all business types...

- Service Based Businesses: Such as Contractors, Attorneys, Doctors, Dentists, Car Repair, Salons, Pet Groomers, Consultants, Accountants…and so many more!

- Manufacturing Businesses: From Clothing, Chemicals, Meat Packaging, Steel, Paints, Rubber, Packaging…with so many more!

- Retail Businesses: Including Large Retail, Mom & Pop Stores, Clothing, Sports, Hardware…and so many more!

- Restaurants: All types from large to small, Individual locations to multiple, Bars, Buffets, Coffee Shops, Wine, Pizza Shops, Night Clubs…with so many more!

Let Me Show You How Simple It Is To Use The MyOverhead System...

“You Start by Entering your Company Data into our system and the process is Extremely Fast and Easy!!“…

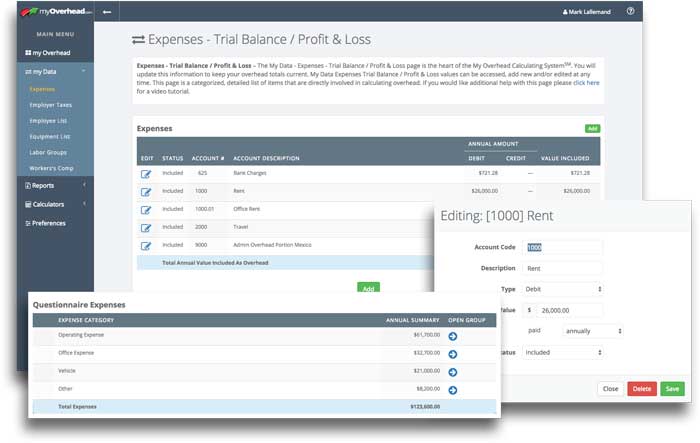

Expenses

MyOverhead.com is powerful enough to allow you to quickly enter your company’s expense data, yet simple enough you can plugin YOUR expenses or use our expense upload feature. Use your Profit & Loss Report from your accounting software or our simple questionnaire form if you don’t have up to date data or don’t use accounting software.

“Eliminate all the Guessing in what you should or shouldn’t include in your numbers to Calculate your True Exact Overhead and Break-Even Costs“…

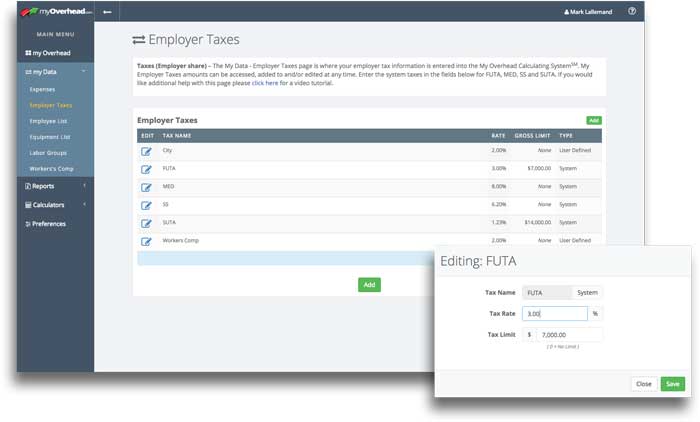

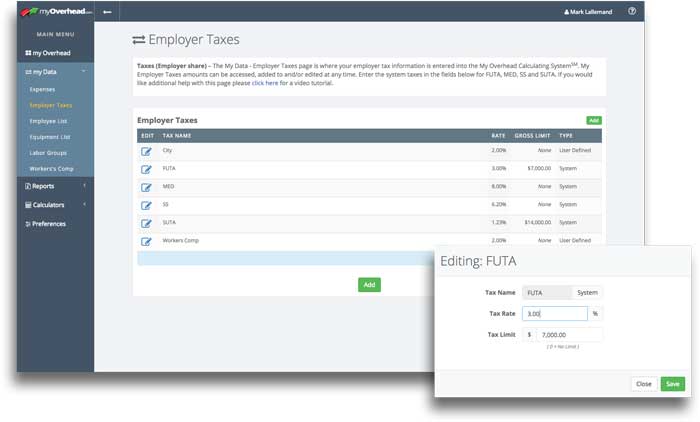

Employer Tax Share

Next you simply enter your company’s employer tax share into the MyOverhead.com system.

Your employer’s tax share is easily found online if you are unsure of the percentages you pay on each employee. Our system takes care of the rest of the calculations.

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

Employees

“The system is completely Safe and Secure and we have been the Trusted Source for Businesses to Calculate True Overhead and Break-Even Costs Since 2001“…

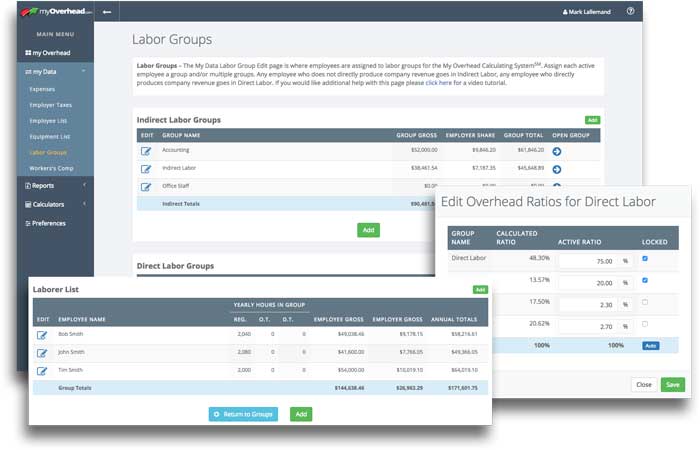

Labor Groups

Next comes Labor Groups which is the heart of our system. Assign your employees to different labor groups and all of your business overhead and remaining numbers can be viewed by those labor groups. Create labor group divisions, crews, departments, sections or how ever you would like to see your numbers broken out. You can adjust the amount of expenses each group has applied to it by percentage or hours.

“The myOverhead System has reports that are Easy to Understand and used to Establish your Correct Pricing Structure for the Services and Products you sell“…

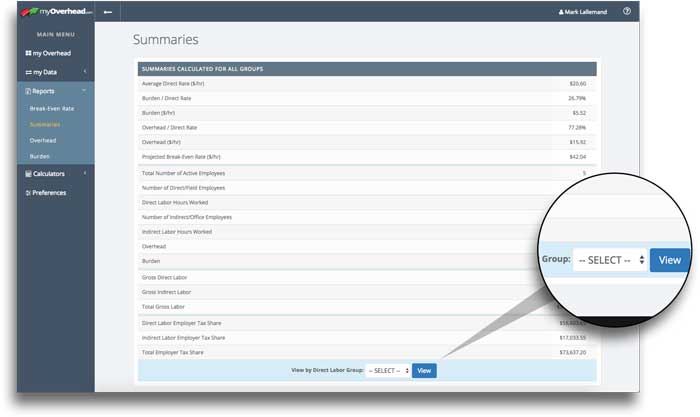

Summary Reports

View all of your numbers instantly, choose from the drop down view to see how each labor group stacks up against your overall company numbers. This makes it easy to determine each labor group, department, crews, etc… Overhead and Break-Even Costs. Once known, making pricing adjustments to ensure desired profit margins are reached is easily achieved.

“You will Use the Calculated Numbers the myOverhead system Reports Provide to Ensure you are Recovering all of your Operating Costs in your Pricing Structure“…

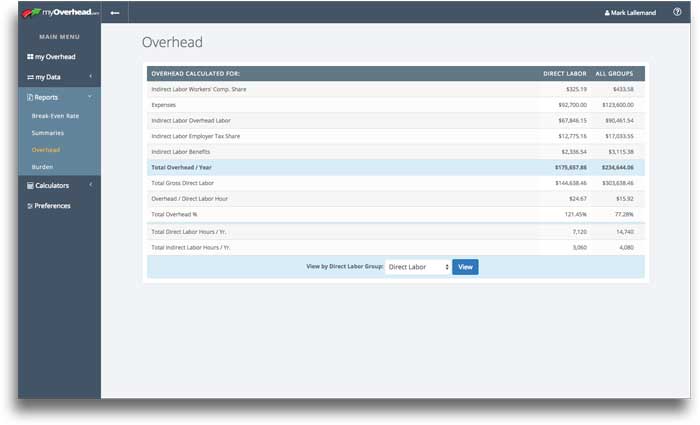

Overhead Reporting

With the Overhead Report your numbers are all broken out so you can see exactly what makes up your overhead costs for your company. You are able to also use the view drop down just like in the summary reports to see all your overhead costs for each labor group you create.

“Effortlessly Keep your Numbers Current because Updating your Data only takes Minutes to Apply Changes for your company”…

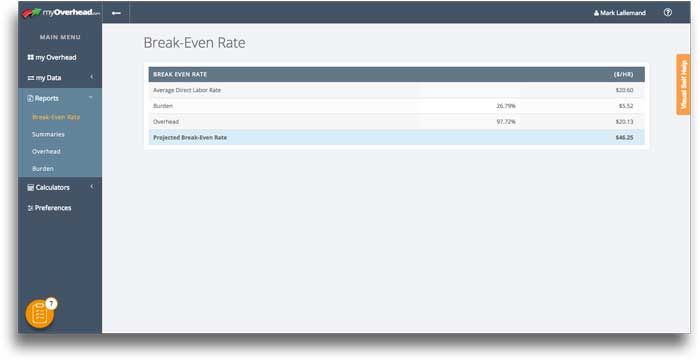

Break-Even Reporting

The Break-Even Report will display your numbers that make up your Exact Break_Even rate per hour. In the Summary report you can see your Break-Even numbers for each labor group you create. Use this number for every direct labor employee hour worked. This number will determine if you are charging the correct price for your services or products you sell.

“Updating your Data as your numbers change will Eliminate Profit Margin Erosion in your Business”…

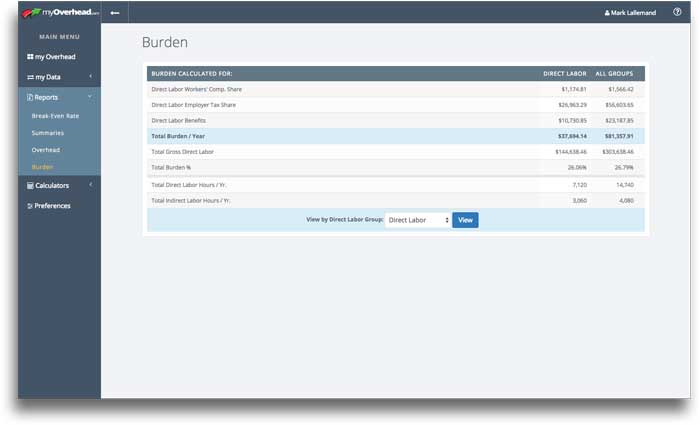

Burden Reporting

With the Burden Report your numbers are all broken out so you can see exactly what makes up your labor burden costs for every employee. You are able to also use the view drop down just like in the summary reports to see all your burden costs for each labor group you create.

“After all your data is quickly entered, the System will Instantly Calculate your Numbers to reveal your Overhead Rate, Break-Even Rate and your Burden Costs for your Company”…

“Thank you Mark!

You and Myoverhead.com have absolutely been one of the best decisions I’ve made for my company! I have struggled trying to figure out my exact costs on my own for years and even after asking other contractors and my CPA, I received no real answers or a fix to my struggle. From an internet search I found your site and I was hopeful this was the answer I was looking for and signed up. I took the numbers your site showed me and applied them to my company immediately. The results from doing so had an immediate impact on my company’s profit margins and in less than a month my profits are now up 9% from the previous year.

"in less than a month my profits are now up 9% from the previous year"

Greg Blanchard

Kevin Skelton

Owner, KPS Plumbing

Start Calculating Your Business Overhead and Break-Even Costs Today

Mark Lallemand

Since 2001 | Celebrating 21 years