Mastering How to Calculate Break-Even Costs: Unlock Financial Success with These 2 Proven Strategies

Learn how to calculate break-even costs effectively and gain insights into your financial planning for better decision-making.

Calculating break-even costs is key to running a successful business. This number tells you how much you need to sell to cover your costs. Understanding this can help you avoid losses and make better choices for your company.

Key Takeaways:

- Break-even point shows how much you need to sell to cover costs.

- Fixed costs do not change, while variable costs do.

- Knowing your contribution margin helps in pricing your products.

- Regularly updating your costs is vital for accurate calculations.

For a deeper understanding of your financial metrics, consider exploring tools that assist in budgeting and financial analysis.

What Are Break-Even Costs?

Break-even costs are the total expenses that must be covered before your business begins to make a profit. These costs include both fixed and variable expenses. Fixed costs are the same no matter how much you sell, while variable costs change based on your sales volume.

Why Is Break-Even Analysis Important?

A break-even analysis helps you understand the financial health of your business. It shows you the minimum sales needed to avoid losing money. This analysis is useful when launching new products or services. It can also guide pricing decisions to ensure expenses are met while making a profit.

| Cost Type | Description | Examples |

|---|---|---|

| Fixed Costs | Costs that remain constant regardless of sales | Rent, salaries, insurance |

| Variable Costs | Costs that change based on the level of production | Raw materials, labor costs |

| Total Costs | Sum of fixed and variable costs | Total of all expenses |

Understanding Fixed and Variable Costs

Fixed Costs

Fixed costs stay the same regardless of how much you sell. Examples include rent, salaries, and insurance. You have to pay these costs even if you sell nothing.

Variable Costs

Variable costs change based on your sales. For example, if you run a bakery, the cost of flour or sugar will increase as you bake more goods. These are directly tied to production levels.

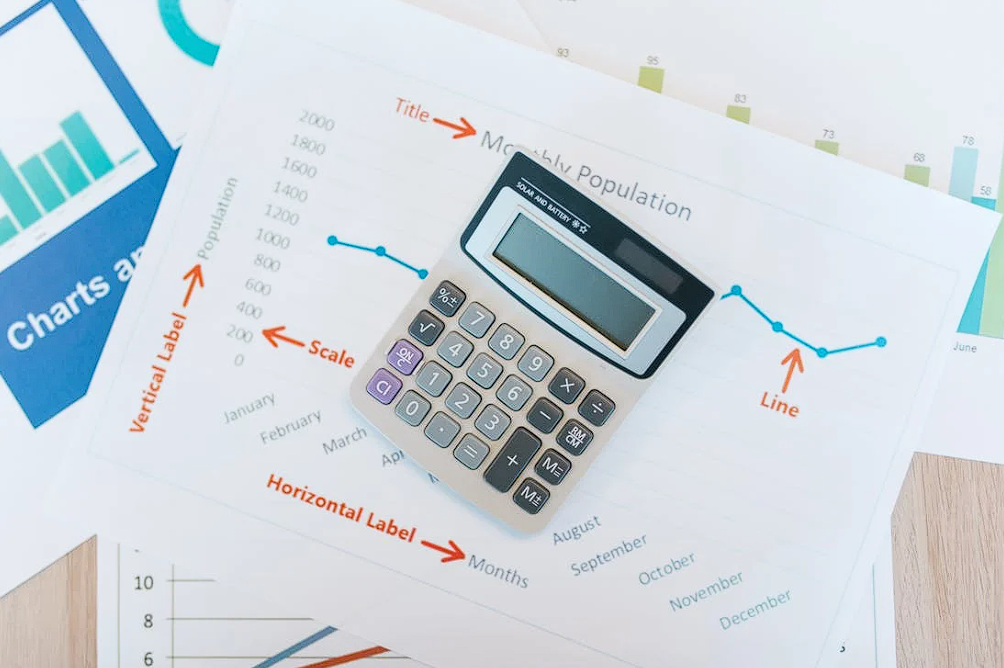

Calculating Break-Even Costs

To find your break-even point, you can use a simple formula. Here’s how you do it.

Break-Even Point Formula

The formula for calculating the break-even point in units is:

Break-even point (in units) = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Example Calculation

Let’s say your fixed costs are 10 dollars,000 a year. Each unit sells for 50 dollars, and the variable cost per unit is 30 dollars. Using the formula:

- Selling Price – Variable Cost = 50 dollars – 30 dollars = 20 dollars

- Break-Even Point = 10 dollars,000 / 20 dollars = 500 units

This means you need to sell 500 units to break even.

Get a DEMO here.

Finding Your Contribution Margin

The contribution margin is the amount of money left from sales after covering variable costs. It helps you understand how much each sale contributes to fixed costs and profits.

Contribution Margin Formula

To calculate the contribution margin, use this formula:

Contribution Margin = Selling Price – Variable Cost

Using our earlier example, the contribution margin is 20 dollars. This means each unit sold contributes 20 dollars toward covering fixed costs.

Key Benefits of Understanding Contribution Margin:

- Pricing strategy: Helps inform pricing decisions.

- Cost control: Identifies areas to reduce variable costs.

- Profitability analysis: Assesses the profitability of individual products.

The Importance of Regularly Updating Costs

Costs can change over time. Raw materials may become more expensive, or you might need to hire more staff. Regularly updating your break-even calculations helps you stay aware of any shifts in your financial landscape.

Tracking Costs Effectively

Keeping Records

Good record-keeping is essential. Use accounting software to track expenses. This can help you see trends over time and adjust your operations accordingly.

Analyzing Trends

Look for patterns in your sales and costs. Analyzing data can help you decide when to raise prices or cut costs.

Tips for Price Setting

Setting the right price is crucial. If your price is too low, you might not cover your costs. If it’s too high, you could lose customers.

Research Your Market

Look at what competitors charge. Understand what customers expect. This market research can help you set a competitive price.

Calculate Your Costs

Ensure you know all your costs. Use your break-even calculations to find a price that covers costs and earns profit.

Using Break-Even Analysis for Decision-Making

Break-even analysis can guide many business decisions. Here are some key areas.

Launching New Products

Before launching a new product, calculate the break-even point. This helps you determine if the product will be profitable.

Adjusting Prices

If sales slow down, consider reviewing your pricing. Use your break-even analysis to see if you can lower prices while still covering costs.

Expanding Your Business

If you think about expanding, run a break-even analysis for the new location or product line. This helps you assess risk before making financial commitments.

| Scenario | Recommendation | Tools to Use |

|---|---|---|

| New Product Launch | Calculate break-even before launch | Financial forecasting tools |

| Price Adjustments | Assess impact on sales volume | Spreadsheet analysis |

| Business Expansion | Conduct risk assessment | Break-even calculators |

Common Mistakes in Break-Even Analysis

Ignoring Fixed Costs

Some businesses overlook fixed costs when calculating break-even points. This can lead to underestimating how much you need to sell.

Miscalculating Variable Costs

Variable costs can change often. It’s crucial to track these accurately. Use historical data to estimate future costs.

Not Updating Regularly

Once you calculate your break-even point, don’t forget about it. Regular updates can help you spot issues before they become serious.

Real-Life Example of Break-Even Analysis

Imagine you want to start a coffee shop. Your fixed costs, including rent and utilities, are 3 dollars,000 a month. Each cup of coffee sells for 5 dollars, and the variable cost per cup is 2 dollars.

- Calculate contribution margin:

Contribution Margin = 5 dollars – 2 dollars = 3 dollars - Calculate break-even point:

Break-even Point = 3 dollars,000 / 3 dollars = 1,000 cups

You need to sell 1,000 cups each month to cover your costs.

Tools for Break-Even Calculations

Various tools can help you calculate break-even costs.

MyOverhead Software

Using a specialized program like MyOverhead can simplify this process. This software is designed to help businesses calculate overhead costs quickly and easily. It allows you to see your numbers clearly, making decisions easier.

Spreadsheets

You can also use basic spreadsheet programs to track costs. Set up formulas to calculate your break-even point automatically as you enter new data.

For a more comprehensive approach to managing your financial data, you may also want to check out detailed accounting software options.

The Bottom Line

Knowing how to calculate break-even costs is vital for your business. It helps you make informed decisions about pricing, product launches, and expansions. Regularly updating your data keeps you aware of your financial situation.

Final Thoughts

Take the time to calculate your break-even point. It can save you from making costly mistakes. With the right tools and knowledge, you can manage your business better and improve your profits.

Start Using Break-Even Analysis Today

If you haven’t already, get started with calculating your break-even costs. Understanding these numbers can lead to smarter business decisions. Use tools like MyOverhead to make the process easier and more accurate.

Remember

Success in business often comes down to knowing your costs. Don’t let guesswork drive your decisions. Accurate calculations give you the confidence to grow your business effectively.

By following these steps and using the right tools, you’ll be on your way to mastering your break-even costs. This knowledge can help you pave the way toward a profitable future in your business.

Leave a Reply