Dental Office Overhead: Costs, Breakdowns & Strategies to Reduce Expenses

Understanding Dental Office Overhead & Why It Matters

Are you a dental practice owner looking to analyze operational costs to run your business efficiently? To provide the best facilities for your clients, you need a well-staffed team, high-quality supplies, and expanded amenities. However, to stay profitable, closely monitoring your dental office overhead expenses is essential.

Managing overhead costs will boost profitability while strengthening the financial health of your dental practice. Overhead expenses include salaries, rent, supplies, and equipment. High overhead can reduce growth opportunities, decrease profits, and strain your financial health if not managed properly.

Our Partners

Dental Office Overhead Breakdown: Fixed & Variable Costs

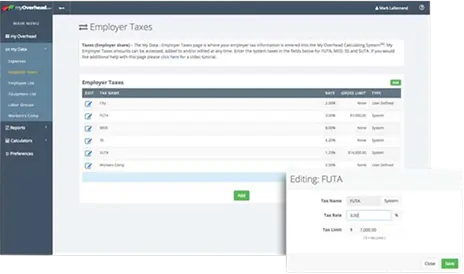

Here, with MyOverhead, you can analyze a detailed breakdown of your dental office overhead, categorized into fixed and variable costs.

Fixed Costs:

A professional and comprehensive breakeven analysis calculator helps businesses identify the critical point where total revenue equals total cost. The MyOverhead calculator helps companies manage and control expenses, set realistic pricing, and make informed decisions.

Rent

Mortgage or lease expenses are considered fixed payments, ensuring you have a stable space to carry on your dental practices. This price remains stable no matter how many patients you visit daily.

Insurance

Insurance covers property damage, liability, and employee-related dangers. Premium insurance is considered an essential dental overhead that doesn't fluctuate.

Equipment Maintenance

Prioritizing regular maintenance of dental equipment will help you restrict costly breakdowns. Maintenance and repairs are predictable. So, it is known to be a fixed expense. Understanding the breakdowns will ensure seamless operations.

Variable Costs

Insurance covers property damage, liability, and employee-related dangers. Premium insurance is considered an essential dental overhead that doesn't fluctuate.

Supplies

Dental equipment, materials, and sterilization products differ per the number of patients and treatment requirements. So, this will come under the category of fluctuating expenses. You can abide by our overhead calculator at myOverhead to manage the costs.

Salaries

Staff salaries have remained fixed since the beginning. But, some overtime expenses, hourly wages, and bonuses depend on the operations and number of patients. So, this expense doesn't have a steady base.

Marketing

Leading dental practitioners include digital campaigns, advertising efforts, and promotions to amplify their business objectives and seasonal trends. So, this approach can influence your overall dental practice overhead calculation. It needed to be managed precisely.

Get started today in three simple step

Start with Entering Info

Import your Profit & Loss Statement from your accounting system or simply enter from our questionnaire or data entry form

Allocate your Costs

Allocate all your costs into the correct division of your company so our system can determine your exact cost and rates

Adjust to Ensure Profits

Our system will show you exactly which services or products are profitable and what price points are needed if they are not

Dental Office Overhead Percentages: Industry Benchmarks & Statistics

Analyzing dental office overhead statistics will help assess your dental practice’s financial stability. A well-structured dental office should maintain specific overhead percentages to remain profitable. For example, salary ratios should be between 20% and 24%, laboratory expenses between 8% and 10%, facility costs between 4% and 6%, and marketing costs between 2% and 5%.

If you are confused about gaining a potential percentage, rely on our myOverhead calculator to access the percentage cost-effectively. The dental industry exceeding 75% of overhead may feel the strain to acquire profitable aspects, whereas those with below 60% can have higher margins. Some influential financial metrics involve collection rates, production per hour, profit margins, etc.

Easily Calculate (all) your

Business Hourly Rates...

OVERHEAD RATE

All Overhead Costs Including Rate Per Hour, Percentage of Labor and Annual

All Break-Even Costs Including Rate Per Hour | Week | Month | Annual and Sales Revenue

LABOR BURDEN RATE

All Labor Burden Costs Including Rate Per Hour, Percentage of Labor and Annual

LABOR GROUP RATE

All Business Numbers can be broken out by Divisions | Crews | Departments or any way you Require.

PROFIT MARGIN RATE

All Profit margin totals, annual, percentages and the most important, your profit per hour rate

SELLING RATE

How much you need to charge per hour to recover all operational costs with your profit margin included

How to Calculate Your Dental Practice Overhead?

It is essential to understand the overhead calculation of dental practice to maintain profitability. The basic formula is:

Overhead percentage = (Total Expenses / Total Revenue) × 100

First, align your expenses and categorize them into fixed and variable costs. Then, compare these costs against your revenue. Finally, you can use our Overhead calculator to track your expenses accurately.

However, you have to avoid some common mistakes like not updating expense records, not valuing hidden costs, etc. If you do not value your overhead cost, you may face cash flow problems. You can utilize our financial tracking tools and monitor your expenses to initiate data-driven decisions. You also need to analyze dentist overhead expenses to acquire long-term financial goals. So, review your finances and let your practices approach productivity.

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

Strategies to Reduce Dental Office Overhead & Increase Profitability

You need to adopt a series of techniques to reduce your dental office overhead. You can optimize your staffing by grasping the concise team size that will lessen the labor charges. You can retrain your employees to update their knowledge instead of going for additional hires. You can negotiate with your suppliers and demand discounts on bulk products to cut down your supply chain expenses. Review your service fees and manage them per industry protocols to ensure profit in your finances.

You can implement cost-saving techniques like digital record keeping, energy-efficient equipment, etc., to reduce expenses in the future. Manage your costs proactively and improvise your financial strategies to enhance profitability in your dental practices. However, you have to plan the expenses so as not to compromise your quality.

How Tracking Overhead in Financial Statements Helps Your Practice?

If you consider revising your financial reports and dental overhead breakdown regularly, then it will ensure profitability. Some integral reports, like cash flow assessments and profit and loss considerations, can verify cost trends and deficiencies. A detailed analysis will allow the practitioners to magnify the areas where they need to reinvest and save expenses.

With a thorough partnership with CPA, we can deliver professional insights into tax optimization, expense management, and much more. Most importantly, you will abide by great financial planning that will last long. A CPA will also assist you in setting reliable budget goals and ensure you acquire the best deductions possible.

“The system is completely Safe and Secure and we have been the Trusted Source for Businesses to Calculate True Overhead and Break-Even Costs Since 2001“…

“The myOverhead System has reports that are Easy to Understand and used to Establish your Correct Pricing Structure for the Services and Products you sell“…

Advanced Techniques for Overhead Management & Long-Term Success

Considering automation and technological benefits will influence your overhead cost to be minimized in the future and will improve its efficiency. Partner with cloud-based software to align your patient records, scheduling, and billing process to lessen administrative and labor costs. With automation, you can adopt the help of AI-integrated tools to digitize your payment options and reduce manual tasks.

You can also use data-driven marketing strategies like social media engagement, online advertising, etc., to ensure your business performs well in front of digital strands. These advanced solutions can optimize your dental overhead expenses and accelerate profitability. This way, you can also acquire long-term success and stand strong.

Give our users a great experience

Frequently Asked Answered.

How is dental office overhead calculated?

First, you have to segregate all your expenses and start by adding them. Once you have the total count, calculate it easily by dividing it by the gross income. You can also use our in-built overhead calculator for authentic results.

What factors influence overhead percentages in a clinic?

Several factors influence the clinic’s overhead percentage. The major ones are fixed and variable costs, which include rent, salaries, production levels, insurance costs, variable costs, raw materials, and much more.

Which expenses are included in a practice's cost breakdown?

A practice cost breakdown generally consists of costs related to direct patient care, such as administrative tasks, billing, and occupancy. It is essential to calculate these expenses to make an office run efficiently with no drawbacks.

What is the ideal budget distribution for a dental setup?

The budget allocation should be around 60 to 70% of overhead charges to set up an effective dental setup. You can go for 20 to 25% for rent and insurance as they are fixed payments. On the other hand, for variable costs, you can take up to 40 to 45%.

How do statistics help in managing operational costs?

With statistics, you will be highly profitable in managing the operational costs. It will deliver reliable insights regarding revenue patterns, cost trends, efficiency, etc. You can easily verify inefficiencies in your practice by precisely analyzing the profit margins, overhead percentages, acquisition charges, etc.

Does this tool provide an overhead breakdown for clinics?

Yes, this valuable tool delivers precise overhead breakdown for clinics. It can easily categorize expenses into fixed and variable costs. It also analyses your financial trends along with expenditure and cost management optimization.

Can the software analyze cost trends in dental offices?

Yes, the software can easily analyze the cost trends in dental offices. It effectively tracks the charges over time, highlights the deficiencies, and verifies the expenditure pattern of the office. It also delivers insights into overhead distribution to help you make better decisions.

Is there a way to compare practice expenses efficiently?

Our software will allow you to compare practice expenses effectively by creating detailed financial reports. It benchmarks the cost against industry protocols and verifies expenditure trends. Through this, you can make data-driven adjustments to enhance your financial performance.

How does this platform assist in financial planning?

The following platform helps in financial planning by tracing overhead costs and expenses and effectively curates financial reports for better results. It helps verify cost-saving opportunities and optimize budget planning to help you make data-driven decisions.

What makes this solution reliable for expense tracking?

The following software is essential and reliable for expense tracking, including automation. It significantly manages data collection and categorizes expenses accurately to deliver real-time financial analysis. Advanced reporting ensures efficiency and accuracy for your business.

My question is not listed here. How can I get help?

If your question hasn’t been listed yet, you can easily contact our supporting team and get help for your queries. Our help center is always ready to serve you with accurate results, and we strive to focus on goal-oriented solutions.

Get in Touch

Have a question for us?

Need expert advice or have a question? We’re here to help! Reach out to us, and our team will get back to you as soon as possible.