Break-Even Analysis: Calculate, Optimize & Forecast Your Business Profitability

What Is Break-Even Analysis & Why

Does It Matter?

Every business faces risks, but to assess their extent, it is essential to understand the significance of a breakeven calculator. Breakeven analysis is a crucial financial metric for business owners, comparing sales revenue to the fixed costs of running a business. The key components for calculating the breakeven point include variable costs, fixed costs, revenue, and contribution margin.

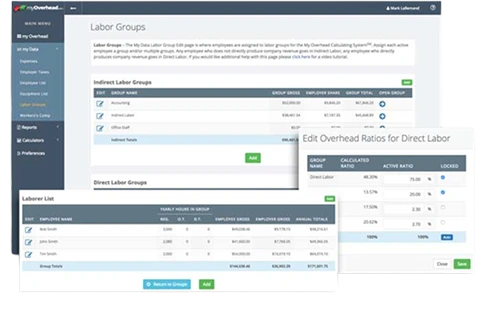

When a company calculates its breakeven point (BEP), it determines the sales volume required to cover all fixed costs before generating a profit. With MyOverhead, you can quickly calculate your business costs with ease.

Our Partners

The MyOverhead calculating system works for all business types...

If you want your business to succeed in the market, it is essential to understand its financial aspects. We use a professional breakeven point calculator to conduct your breakeven analysis. This helps businesses determine their revenue, manage costs, and make strategic decisions.

Understanding the Breakeven Concept in Business

A professional and comprehensive breakeven analysis calculator helps businesses identify the critical point where total revenue equals total cost. The MyOverhead calculator helps companies manage and control expenses, set realistic pricing, and make informed decisions.

Breakeven Analysis vs. Profitability Analysis

The breakeven analysis calculator determines when a company covers its costs, whereas profitability analysis goes further by assessing overall financial health and profit margins. Both play a crucial role in helping companies maximize their revenue.

Key Benefits of Conducting a Breakeven Analysis

If you access a thorough breakeven calculation, you will have clarity on cost management, pricing strategies, and risk mitigation. With our breakeven point analysis calculator, you can optimize your operations and enhance your financial planning for the future.

Restaurants:

All types from large to small, Individual locations to multiple, Restaurants, Bars, Buffets, Coffee Shops, Wine, Pizza Shops, Night Clubs…with so many more!

Get started today in three simple step

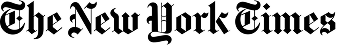

Start with Entering Info

Import your Profit & Loss Statement from your accounting system or simply enter from our questionnaire or data entry form

Allocate your Costs

Allocate all your costs into the correct division of your company so our system can determine your exact cost and rates

Adjust to Ensure Profits

Our system will show you exactly which services or products are profitable and what price points are needed if they are not

How to Calculate Your Breakeven Point?

Breakeven Calculation is essential for analyzing when your company will start initiating its profit. It generally includes verifying variable costs and analyzing revenue quickly.

Break-Even Formula & Key Components

Fixed Costs + Variable Costs vs. Revenue

Here, the fixed price remains constant, whereas the variable cost differs with production. Comparing the following revenues, you can understand the breakeven point.

Breakeven Units vs. Breakeven Revenue

With breakeven units, you can understand how many products have to be sold, whereas the breakeven revenue calculates the whole income needed to cover the costs.

Step-by-Step Guide to Breakeven Calculation

Identifying Fixed & Variable Costs

You need to list down all the fixed prices and variable costs like equipment, materials, and labor per unit.

Setting the Right Selling Price

Our breakeven analysis application will help you price all the products strategically to cover the entire price while remaining competitive in the market.

Analyzing Cost-Volume-Profit (CVP) Relationships

A breakeven analysis for a service company verifies how cost and sales volume influence profitability to make informed decisions.

Easily Calculate (all) your

Business Hourly Rates...

OVERHEAD RATE

All Overhead Costs Including Rate Per Hour, Percentage of Labor and Annual

BREAK-EVEN RATE

All Break-Even Costs Including Rate Per Hour | Week | Month | Annual and Sales Revenue

LABOR BURDEN RATE

All Labor Burden Costs Including Rate Per Hour, Percentage of Labor and Annual

LABOR GROUP RATE

All Business Numbers can be broken out by Divisions | Crews | Departments or any way you Require.

PROFIT MARGIN RATE

All Profit margin totals, annual, percentages and the most important, your profit per hour rate

SELLING RATE

How much you need to charge per hour to recover all operational costs with your profit margin included

Break-Even Analysis Example & Common Pitfalls

If you understand breakeven analysis with the help of real-world scenarios, it allows businesses to apply our financial tool conveniently. However, you also have to prevent yourself from common pitfalls, as any mistake can lead to inaccurate results that will further affect your decision-making and profitability.

Practical Example of Breakeven Calculation

Consider your company is selling a product for $ 50 with a fixed price of $10,000, and the variable cost is $20. You can take, Breakeven units=Fixed Costs/ Selling Price-Variable cost per unit. Breakeven units=10,000/50-20=334 units.

What Happens When Costs or Prices Change?

When the cost price changes, it can directly influence your breakeven point. Elevating the costs will require higher sales.

Common Mistakes to Avoid in Breakeven Forecasting

Some mistakes you need to avoid during breakeven analysis for a startup business include ignoring market changes, miscalculating the prices, setting unrealistic prices, etc.

“Eliminate all the Guessing in what you should or shouldn’t include in your numbers to Calculate your True Exact Overhead and Break-Even Costs“…

Interactive Cost-Volume-Profit Analysis Tool

This dynamic cost-volume-profit analysis tool analyses how trending costs, prices, and sales are changing. This impacts your profitability, which allows you to go for strategic planning. Making data-driven financial decisions helps your business grow significantly over the competitive edge. So, consider our most straightforward calculator to understand your business costs easily.

Breakeven Calculator: Get Instant Results

Now, authentically determining your breakeven point is easier with our comprehensive breakeven profit calculator. No matter if you demand breakeven analysis for rental property, breakeven analysis for a restaurant, or breakeven analysis for a service business, everything is possible with our tool.

Free Online Breakeven Calculator

Our online and free breakeven calculator helps in cost pricing and figuring out the instant breakeven solutions without any complicated formulas.

Downloadable Breakeven Analysis Excel Template

The customizable Excel template allows a business to verify costs, revenue, and profitability trends with automated calculations.

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

Break-Even Analysis & Business Growth Strategy

Well-evaluated breakeven costs and analysis help a business to grow strategically. It accesses better cost management due to market fluctuations.

How Your Breakeven Point Affects Pricing & Profitability?

Proper breakeven points will set competitive costs while managing profit margins. Strategic pricing adjustments impact revenues and your financial stability.

Scaling a Business While Managing Costs

When a business grows, its costs also increase. So, effective cost management assures that scaling efforts are sustainable and profitable in the market.

“The system is completely Safe and Secure and we have been the Trusted Source for Businesses to Calculate True Overhead and Break-Even Costs Since 2001“…

Sensitivity Analysis: Adapting to Market Changes

If you understand how variables change over time, like demand shifts of the customers and the supply costs, it affects the breakeven point. So, you can abide by our productive and easy-to-handle breakeven revenue calculator, which is free to access. It helps in proactively adjusting the strategies for profitable aspects.

Demand Fluctuations & External Market Conditions

Seasonal trends, economic shifts, etc can also influence the demand. So, the market condition influences the accuracy of your breakeven calculations.

“The myOverhead System has reports that are Easy to Understand and used to Establish your Correct Pricing Structure for the Services and Products you sell“…

Factors That Impact Your Breakeven Point

Many eminent factors influence the breakeven point. Some of the major factors include variable expenses, fixed costs, etc. A business needs to understand these factors to maintain financial stability.

How Fixed Costs Affect Breakeven?

Fixed costs can affect the breakeven in many ways. Higher fixed costs like salaries and rent can elevate the breakeven point, demanding more sales to handle the expenses.

The Role of Variable Costs in Pricing Strategy

Variable costs also play a crucial role in strategizing the price. If production costs rise, businesses should adjust their prices to maintain their margins. For example, if you are considering a breakeven rental property or breaking even on a rental property, you need to optimize it.

Give our users a great experience

Frequently Asked Answered.

What is MyOverHead, and how does it help businesses with breakeven analysis?

MyOverhead is known to be a professional online tool that helps businesses to calculate break even points, overhead costs, profit margins, and labour burden rates. It manages breakeven analysis by verifying the revenue required to handle expenses.

How does MyOverHead's software differ from other applications?

MyOverhead is different from other applications by delivering a user-friendly and all-in-one solution. It helps calculate break-even points, overhead costs, and profitability metrics. It provides authentic labor burdens with proper pricing insights as per your business requirements.

Can MyOverHead's software be used in different industries?

Yes, MyOverhead software is effectively curated and its versatility can be used for several industries such as manufacturing, constructions, retail and service-based businesses. It helps companies assess their break even points and overhead costs. It ensures better financial planning.

Is MyOverHead's calculator free to use?

Yes, MyOverhead delivers a free online breakeven calculator to help companies evaluate their overhead profitability and costs. We also deliver premium plans if you want more advanced features like detailed reports and financial analysis.

How secure is my data when using MyOverHead's software?

MyOverhead is highly precise in securing the data of its customers through endless encryption protocols, and it prevents cloud storage from safeguarding user information. The following platform also ensures compliance and confidentiality with industry regulations.

How do I use the calculator?

Using our calculator is very easy. You just need to enrol with your business cost, labour cost and pricing details into the tool. The application calculates the breakeven points automatically along with profit margins, needed sales revenue and instant insights.

How are breakeven rates calculated?

You can calculate the breakeven rates by dividing the total fixed and variable price by the number of units sold. The software automates the process by factoring in pricing and burden to determine the proper revenue.

Can I use MyOverHead's calculator for rental property analysis?

Yes, you can use MyOverhead calculator to get your rental property analysis. Landlords can quickly analyze their break even points by inputting expenses such as maintenance, mortgage, taxes, and vacancy rates. They can also set optimal pricing to assess profitability.

How often should I perform a breakeven analysis for my business?

It is recommended for you to analyze your breakeven daily, majorly when the cost fluctuates, changes, or when your business grows rapidly. Analyzing it comprehensively will ensure cost control, accurate pricing, and profitability planning.

My Question is not listed here.

If your question is not listed here, feel free to reach out to us directly. You can contact us via email or call, and we’ll be happy to assist you!

Get in Touch

Have a question for us?

Need expert advice or have a question? We’re here to help! Reach out to us, and our team will get back to you as soon as possible.