Optimize Your Business Overhead: Definition, Types, Calculation & Reduction Strategies

What Is Business Overhead?

Let’s explore the fundamental definition of business overhead and how it operates.

Understanding Overhead in Business Operations

Business overhead refers to the essential operational expenses of a business that do not directly contribute to producing goods or providing services. Business overhead costs are recurring and remain constant, regardless of whether the corporation grows.

Key Takeaways About Overhead

Overhead is a recurring and predetermined enterprise expense that is not directly related to product creation. To maximize your corporation's profits and Revenue, carefully calculate manufacturing expenditure. Company overhead costs can be further segmented.

Overhead vs. Operating Expenses: What's the Difference?

Overhead expenses are indirect charges that keep your company running but are unrelated to any specific service or product, like utilities and rent. On the other hand, operating expenses involve both direct and indirect charges.

Our Partners

How to Calculate Overhead Costs?

Here, we will learn how to utilize the total overhead cost calculator for better effects:

Identify Fixed, Variable, and Semi-Variable Costs

Categorize your expenditure by analyzing your fixed, variable, and semi-variable charges. Your overhead costs for small businesses have to be categorized properly for better effects and accurate solutions.

Use This Formula for Overhead Cost Calculation

You must use overhead cost percentage (Total overhead costs/Revenue) x 100 to calculate your overhead expenses percentage. To analyze your expenditure rate, you can use the following: Overhead Rate = Total Overhead Costs/Direct Labor or production expenses.

Compare Your Overhead to Industry Standards

Now, you must benchmark your overhead charges against competitors and industry averages. High overhead in business will indicate inefficiencies, and low overhead will detect price-efficient operations. So, you need to adjust it accordingly.

Example Calculation of Overhead Costs

Consider your business overhead expense, which is $ 50,000, with total Revenue of $200,000 and direct labor expenses of $100,000. So, Overhead Cost Percentage = (50,000/200,000) x 100= 25%. This implies that 25% of your Revenue will cover your expenditure.

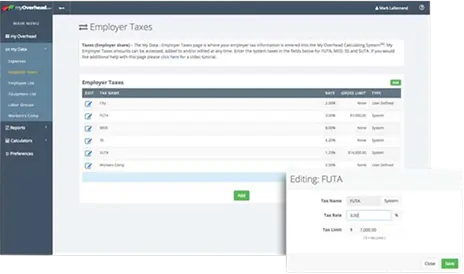

Get started today in three simple step

Start with Entering Info

Import your Profit & Loss Statement from your accounting system or simply enter from our questionnaire or data entry form

Allocate your Costs

Allocate all your costs into the correct division of your company so our system can determine your exact cost and rates

Adjust to Ensure Profits

Our system will show you exactly which services or products are profitable and what price points are needed if they are not

Types of Overhead Costs

Here, we have given some of the most prominent types of overhead expenses for your reference:

If you are confused about gaining a potential percentage, rely on our MyOverhead calculator to access the percentage cost-effectively. The dental industry exceeding 75% of overhead may feel the strain to acquire profitable aspects, whereas those with below 60% can have higher margins. Some influential financial metrics involve collection rates, production per hour, profit margins, etc.

Fixed Overhead Costs

This type of expenditure charge remains static no matter how evolving the corporation's activity is. You have to pay these predetermined expenses regularly. It includes rent and lease payments for warehouses, office space, production facilities, etc.

Variable Overhead Costs (Fluctuate with Corporation Activity)

The corporation's operations change and production and sales levels fluctuate. It includes raw material storage fees, utilities and energy expenses, and shipping & logistic expenses such as packaging, transporting, delivery, etc.

Semi-Variable Overhead Costs (Partially Fixed & Variable)

It has both static and fluctuating elements as per the corporation's requirements. Using our overhead and profit calculator, you can strategize this expense. It includes marketing and advertising charges like seasonal promotions, campaigns, etc.

Overhead Categories in Business

To make your overhead calculation more eminent, you need to understand the expenditure categories in the enterprise as given below:

Production Overhead (Manufacturing Costs Not Directly Related to Production)

Your production expenditure involves indirect expenses needed for manufacturing but is not limited to specific production creation. It includes the corporation's rent and utilities, quality control and inspection charges, equipment maintenance charges, and indirect labor wages.

Administrative Overhead (Office & Corporate Expenses)

This expenditure consists of business management charges that only support operations but do not create direct Revenue. You can easily access our overhead cost calculator to analyze office rent and supplies, management staff salaries, HR, finance, professional services, software, etc.

Selling & Marketing Overhead (Sales-Related Costs)

The following expenses will help your enterprise convert, attract, and retain loyal customers. With proper overhead costs for small businesses, you can handle these expenses for sales teams, advertising, promotional campaigns, customer service, etc.

Financial Overhead (Loan Interest, Banking Fees, and Taxes)

This involves expenses related to managing finances like bank transactions, loan interest, repayment expenses, insurance premiums, taxes, regulations, etc. Analyze these overheads in business with our effective and in-built expenditure calculator.

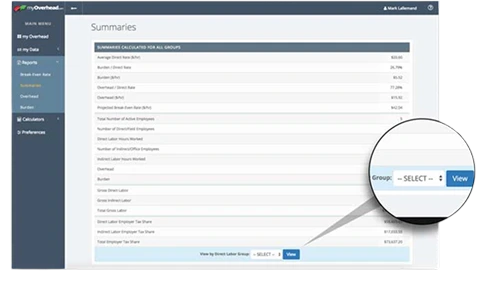

Easily Calculate (all) your

Business Hourly Rates...

OVERHEAD RATE

All Overhead Costs Including Rate Per Hour, Percentage of Labor and Annual

All Break-Even Costs Including Rate Per Hour | Week | Month | Annual and Sales Revenue

LABOR BURDEN RATE

All Labor Burden Costs Including Rate Per Hour, Percentage of Labor and Annual

LABOR GROUP RATE

All Business Numbers can be broken out by Divisions | Crews | Departments or any way you Require.

PROFIT MARGIN RATE

All Profit margin totals, annual, percentages and the most important, your profit per hour rate

SELLING RATE

How much you need to charge per hour to recover all operational costs with your profit margin included

Factors Contributing to High Overhead Costs

High Fixed vs. Variable Costs Ratio

If the allocated manufacturing overhead of your corporation will have a high proportion of fixed expenses compared to variable expenses, you may struggle with financial functionalities. Revenue fluctuations may strain your cash flow.

Inefficiencies & Business Waste

Management defects like outdated technologies, more energy usage, redundant processes, etc., can elevate overhead expenses. Calculating your manufacturing overhead expenses in our calculator can lower your overhead expenses vastly.

Economies of Scale & Business Growth Impact

Scaling up your enterprise too soon without overhead optimization can increase inflated expenses. Growth should minimize per-unit expenses, but poor growth strategies can improve your company's financial strain.

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

Unnecessary Expenses & Poor Financial Planning

You need to calculate your manufacturing overhead cost precisely because of unnecessary expenses like travel. Services and unwanted subscriptions can elevate your expenditure. Have proper financial oversight with appropriate budgeting.

“You Don’t NEED to have any Experience in Accounting or be a Math Genius to Get your True Costs!”…

Outsource Non-Core Business Activities

You need to outsource tasks like accounting, IT support, customer service, etc. This can minimize your expenditure by curbing the requirement for full-time workers. Through this, your whole company's overhead calculation will be safe.

Negotiate Better Deals with Vendors & Service Providers

You can negotiate contracts with landlords, suppliers, and service providers to save outlays. Explore long-term agreements, discounts, and affordable options to reduce the corporation's expenses.

5 Strategies to Reduce Business Overhead Costs

Streamline Operations & Eliminate Unnecessary Processes

Eliminate inefficiencies that unnecessarily increase the expenses without any value. Calculate overhead allocation rate with our integrated expenditure calculator to simplify workflows, optimize resources, and lessen redundant tasks. Cut down expenses and improve productivity.

Implement Automation & Cost-Efficient Technology

Integrating automated tools like AI-driven processes and cloud-based solutions can reduce labor expenses and increase organizational efficiency. With proper overhead percentage calculation, you can invest in price-effective tools.

Regularly Audit & Analyze Overhead Expenses

You must encourage routine expenditure reviews to verify any unnecessary spending included. With our MyOverhead application, you can properly categorize expenses and set your corporation's objectives.

Business Overhead & Accounting Applications

Overhead in Break-Even Analysis

The expenditure price will influence your organization's break-even point. A larger expenditure elevates the break-even point, which requires more Revenue to acquire profitability. Estimated manufacturing overhead cost properly will give financial stability.

How Activity-Based Costing (ABC) Helps Manage Overhead?

Activity-based Costing leverages overhead expenses for certain company activities. This delivers a clear picture of the costs allocated. You can optimize your pricing strategies and functionalities with precise estimated overhead expenses.

Overhead in Balance Sheets & Profit Margins

Overhead charges in financial statements can affect the net profit margins and other economic prospects. On the other hand, the income statement will reflect the impact of the expenditure, and the balance sheet will account for the liabilities connected to your expenditure.

“The myOverhead System has reports that are Easy to Understand and used to Establish your Correct Pricing Structure for the Services and Products you sell“…

Business Overhead Cost Calculator

How to Use a Business Overhead Cost Calculator?

A manufacturing overhead rate calculator will analyze how much of your Revenue has been spent on direct expenses. Firstly, you need to list the overall costs, apply Revenue and direct price, apply formulas, and evaluate.

Download a Free Business Overhead Calculation Template

You can use our overhead absorption rate calculator, like MyOverhead, to get a downloadable template to access automated calculations. You can easily track your expenditures by just providing direct insights.

Overhead & Financial Statements: What Business Owners Should Know

The overhead expenses are given in financial reports, which impact cash flow, income statements, and balanced sheets. Managers can determine overhead rates to manage budgets and curb their spending. With our expenditure calculator, determining overhead costs is easy.

Why Are Overhead Costs Important?

Impact of Overhead on Business Profitability

Business overhead costs impact your organization's profitability by affecting eminence and financial stability. Calculating manufacturing overhead can help you elevate profits and reinvest in enterprise productivity. Excessive expenditures can curb your cash flow.

How Overhead Affects Pricing & Break-Even Analysis?

Overhead charges should be factored into reliable pricing techniques to encourage profitability. A large expenditure can elevate the break-even point, assessing more sales to satiate predetermined expenses. You can use our business overhead calculator to allocate the charges properly.

Give our users a great experience

Frequently Asked Answered.

What services does MyoverHead provide?

With our easily accessible overhead allocation calculator, you can estimate your break-even rate, labor burden rate, labor group rate, selling rate, and profit margin rate. Analyze your budget and accordingly simplify the financial planning.

How does MyoverHead's business overhead calculator work?

Our overhead-applied calculator helps track expenses by analyzing your budget. Just import all your latest data and allocate the costs to divide the charges correctly. Now, the calculator will showcase the exact details.

Is MyoverHead's overhead cost calculator free to use?

Yes, it is completely free to use our MyOverhead calculator. Corporations must provide their expenses, and the calculator will automatically analyze the costs and financial planning for better business goals.

How do I calculate my business's overhead costs?

To calculate your overhead in estimation and Costing, you need to analyze your total variable, fixed, and semi-variable expenses. Then, using the total overhead expenses/Total Revenue) x 100 formula, you can determine the expenditure percentage.

What is the difference between overhead and operating expenses?

Overhead expenses can be your indirect expenses, such as utilities and rent. On the other hand, operating expenses involve direct and overhead expenses like company essentials, raw materials, wages, and daily operations.

How do overhead costs impact pricing and profitability?

If the overhead expenses are higher, it can increase the pricing demands of your corporation, and your profitability may be hampered. So, you need to do online overhead calculations, manage your budget, and lower the expenses.

What factors contribute to high business overhead costs?

Some factors that affect the business overhead expenses are operational inefficiencies, excessive expenses, ineffective financial planning, careless spending, and lack of proper scalability. So, you need to manage these factors with a small business overhead calculator.

How can I reduce my overhead costs without affecting quality?

You can reduce overhead expenses by proper operations, auditing expenses, automating tasks, and outsourcing non-core activities. You can also use our total manufacturing overhead cost calculator to optimize expenses.

How does overhead affect break-even analysis?

Higher overhead can maximize your break-even point, which demands more sales to cover the expenses. However, with lower overhead, you can lessen the break-even threshold through which you can access profitability.

What are the best ways for small businesses to control overhead expenses?

Small companies can control their overhead using a total manufacturing overhead cost calculator. This will help them track their expenses and take steps like outsourcing, automation, negotiation with vendors, etc.

Get in Touch

Have a question for us?

Need expert advice or have a question? We’re here to help! Reach out to us, and our team will get back to you as soon as possible.